The iPod All Over Again

February 20, 2015I came, iPod, I conquered.

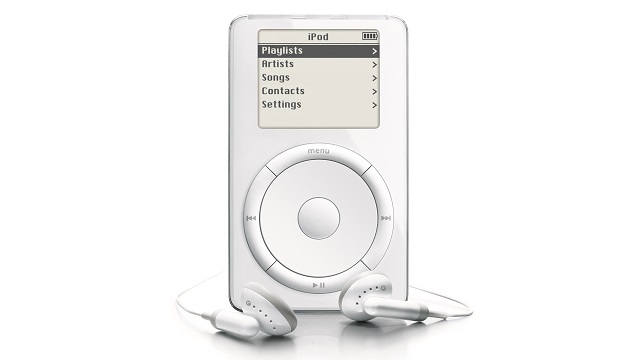

The Apple Watch takes a page from a playbook Apple first wrote in 2001. The rise and success of the Apple Watch will be a lot more like the iPod and less like the iPhone or iPad.

The Apple Watch will be popular. Far more popular than its critics imagine. By itself, the Apple Watch has more than enough features and benefits to be a hit product. And those features and benefits will grow through 3rd party apps, enabling all sorts of uses we haven't thought of yet. Since the iPod, each new Apple product takes less and less time to reach mass adoption after launch. The Apple Watch will continue this trend as Apple leverages a user base that’s grown by at least 250 million people since 2010 when the iPad was launched.

Misunderstood growth patterns.

Much like the growth pattern of the iPod, the Apple Watch's popularity will grow in three stages where, first: it will sell to Apple's massive and affluent base of 150+ million iPhone 5s /5c / 6 customers. In both cases, the Apple Watch and iPod (Mac-only at first) will launch into “niche” markets. Second: the next version of the Apple Watch will gain independence from the iPhone and become a standalone product, enabling it to address a global market, like the iPod did when it gained compatibility with Windows. Third: As Apple keeps pushing the limits of mobile CPU design, software engineering, batteries, low-power 4G communications, and voice recognition, the Apple Watch has the potential to replace your smartphone in the years ahead. In order to understand Apple’s successes, it’s important to remember that Apple is not afraid of cannibalizing its own product lines - something that sets it apart from its competitors. The iPod nano cannibalized customers from the classic iPod; iPhone took customers from the iPod; iPad took customers from the line of MacBooks. If future Apple Watches take sales away from iPhones, that's fine with Apple because those customers stay with Apple.

Widely panned as too expensive.

An unsurprising similarity the Apple Watch shares with the iPod is that it's being widely panned by critics as too expensive. Tech journalists, pundits, and analysts are making the same wrong assumptions each time a new Apple product is announced. Like the iPod, iPhone, and iPad before it, critics are missing the boat by comparing the Apple Watch to products already on the market. As was the case with the iPod, these critics don't understand how the Apple Watch is nothing like the products that came before it. They can't imagine the future unless someone shows it to them. And even when someone does, they seem to frame the future in the context of the past. Every time a new Apple product ships, this lack of imagination leads to the same people explaining how Apple will fail while lacking the ability to explain how Apple succeeds. The Apple Watch is no different: the tech media has it wrong - again. Apple has proven its ability to figure out what consumers want before they do. The Apple Watch isn’t too expensive, and Apple is going to sell millions of them this year.

Because most Apple nay-sayers don’t understand what makes it successful, they focus on things like utility and specifications instead of benefits and desire. Analysis of the Apple Watch and its potential success or failure is even more confused than analysis of previous Apple products. This is because the tech media doesn't have a clue about fashion. Across the board, those panning the Apple Watch dismiss its role as a fashion accessory - they only see it is a superfluous gadget. It doesn't take a rocket scientist to see the appeal of waving one's hand in front of a checkout and having your watch make a biometrically secure, private transaction in 2 or 3 seconds. Underestimating the Apple Watch as a fashion accessory might be forgivable for tech writers. Underestimating the features and benefits - even the specifications of the Apple Watch - is not. Apple Watch critics fail to grasp the device as a fashion item and fail to understand how much design really matters when it comes to things you wear.

Peerless design. Peerless market.

When it comes to design, Apple remains peerless. It's interesting [funny?] how the same people who claim Apple is nothing more than a marketing company with fancy product designs, fail to understand how having design chops is what matters most when it comes to jewelry and fashion. Those who think design isn’t important can’t understand why Apple’s high end market segments continue to expand. It’s simple: As mass markets mature, people’s tastes, needs, and wants do too. Customers become more sophisticated over time - not less. If you’re not constantly pushing the limits of design, you can't keep up with the market's evolving needs - and certainly not its wishes and desires.

Compared to the iPod, the Apple Watch will explode out of the gate. Fast forward 14 years from 2001 and Apple has hundreds of millions of satisfied, loyal customers and a vast ecosystem that ties everything together. The iPod’s market finally came into its own when Apple made it, and iTunes, compatible with Windows. Similarly, when Apple can bake more technology into the Apple Watch, it will become a standalone device no longer confined to a “niche” market of iPhone users. Perhaps niche isn't the right word when describing 150 million affluent, credit card carrying, loyal customers. The rise of the iPod began as a trickle where the rise of the Apple Watch will begin as a fast moving river, both feeding the ever-rising ocean of Apple.

Global status symbol.

It took several years and a killer iPod marketing campaign (remember those dancing silhouettes with white earbuds?) for the iPod to become a fashion statement. The Apple Watch, by comparison, will achieve that status over night. People go out of their way to express their individuality through what they wear. For many, the Apple Watch will be the most personal piece of technology they own. In order to understand its appeal, you have to see it as a fashion accessory just as much as the best smart watch you can buy. Changing the watch face is a big deal when it comes to customization, but being able to swap straps for your Apple Watch means you can choose a physical style appropriate for what you’re wearing and how you feel. That in turn will spawn a market for 3rd party straps which will in turn confer even more value on your Apple Watch purchase. If you can upgrade to Apple Watch 2.0 and keep all your straps, Apple will have created yet another new sticky ecosystem of apps and now straps.

Regardless of how much you pay for your Apple Watch or your straps, the functionality is the same for everybody. A gold Apple Watch isn't *better* than an aluminum one. Think about it: The functionality of a $350 Apple Watch Sport is the exact same as a $10,000 18k gold Apple Watch Edition. Can you think of another company that does that with a product line? The Apple Watch is a contradiction in terms: Affordable and exclusive; customizable and standardized; utilitarian and beautiful. Apple has created a magic formula that’s going to define how devices bridge the worlds of consumer electronics and fashion: The Apple Watch will become a global status symbol from the Ghetto to Monaco.

In order to protect that status symbol, Apple is making a quiet yet major departure in marketing from the days of the iPod. Apple lost control of the iPod moniker because like Kleenex, it became the label for all its competing products too. In order to help make sure that doesn’t happen - to avoid people confusing a $50 ‘smartwatch’ with a $10,000 gold Apple Watch Edition, Apple has dropped the i-moniker and instead gone with its own name. This gives it leverage combatting knockoff products and false packaging, especially in China which has clearly signalled its appetite for "expensive" iPhones. Only the daring or dumb would put the word Apple on a package and not expect serious legal trouble. By using its own name in a product, Apple may be able to protect its intellectual property more than it could with patents.

Sidestep the market completely.

Like the iPod, the Apple Watch will redefine a nascent consumer electronics category and spawn new industries to support its rapid growth. And, just like the iPod, Apple will gain control of the market for its key consumer electronic components - but with a twist.

When Apple shifted the iPod to flash storage from spinning hard drives, it overran the flash memory market by buying up supply across the world - up front and in cash, and at an exclusive discount. That was 2005 when spending a billion dollars in cash wasn't pocket change for Apple like it is today. Almost overnight, Apple gained control of a global commodity market critical to its iPod manufacturing. Though sheer buying power, Apple locked its competitors out of supply chain while driving up their pricing at the same time.

Like the iPod, supply of key components for the Apple Watch will be constrained. But instead of buying up supply, Apple is now making the most important components itself. After years of research and development costing billions of dollars, Apple now makes the most powerful, energy efficient mobile processors (system-on-a-chip) in the world, and by a large margin. This makes Apple the only customer for the component that will separate its product from all others. Apple Watch competitors will be relegated to choosing off-the-shelf components that are inferior in both performance and efficiency next to Apple's S1 system-on-a-chip, and at greater cost than Apple's internal manufacturing.

Too fast and too far ahead to copy.

With the iPod, it was the combination of the clickwheel and the iPod’s software interface that put it miles ahead of its competition. With the Apple Watch, it’s Apple’s S1 that will ensure competing products will do less, with paltry performance, and even poorer battery life. With the iPod and the Apple Watch, the things that differentiate it from the competition are difficult to copy and ahead of their time.

With superior design capability, superior custom components, brand recognition, manufacturing at scale, global distribution though hundreds of stores, Apple Pay, and an army of 3rd party app developers, Apple is far enough ahead of the industry that, as was the case with the iPod, its competitors won't ever really catch up.

Just as the iPod did, the Apple Watch will redefine its category, carve out a new consumer electronics mass market, and retain dominance over it. It's how the largest company on the planet will continue to grow at breakneck rates, adding billions to its bottom line, while staying miles ahead of its competition.

Other posts by Chris Marriott

- Seeking Backstage Resellers

- Preemptive Multi-Talking -- Johnny and the Liquidators

- Preemptive Multi-Talking -- Pundits are the worst!

- Preemptive Multi-Talking -- WWDC 2016

- Preemptive Multi-Talking -- Of Cash Piles and Job Cuts

- Preemptive Multi-Talking -- 60 Scary Minutes Edition

- Preemptive Multi-Talking -- [R]Evolution Edition

- Preemptive Multi-Talking -- Pinocchio Edition

- Preemptive Multi-Talking -- FBI vs. Apple

- Preemptive Multi-Talking -- 1984 Edition

- Preemptive Multi-Talking -- Earnings Madness Edition

- Preemptive Multi-Talking -- All your passwords are belong to us.

- Preemptive Multi-Talking -- Fog, Fizzle, Flop Edition

- Preemptive Multi-Talking -- FUD Redux Edition

- Preemptive Multi-Talking -- Privacy be Damned Edition